- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- World’s Largest Stock Exchanges

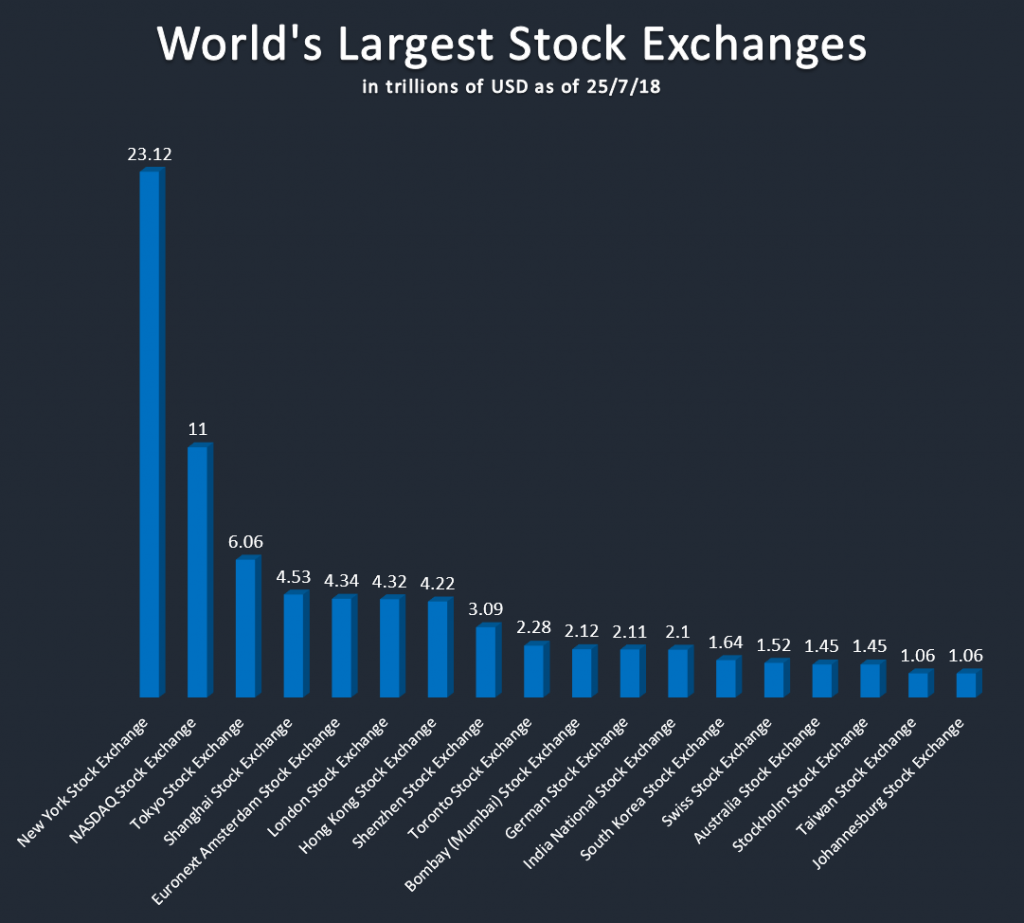

News & AnalysisAlmost every country in the world has a stock exchange with some countries having multiple exchanges. There are over 60 major exchanges across the globe with the total market cap of over $85 trillion. But only 18 of those are in the so-called ”$1 trillion club”. The top 18 stock exchanges have a total value of $77 trillion which makes up around 90% of the total global stock exchange market cap.

United States

The United States has two of the largest stock exchanges in the world – The New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ). NYSE is the largest with a market cap of just over $23 trillion, that’s around $12 trillion more than second largest stock exchange NASDAQ. Some of the biggest companies listed on NYSE include the tech giants Apple, Google, Microsoft and world’s 4th largest company by market cap – Amazon.

Asia

The largest stock exchanges in Asia are located in Tokyo (JPX) and Shanghai (SSE), with total market caps of $6.06 and $4.53 trillion respectively. Some of the largest companies on the JPX include automotive manufacturer Toyota, SoftBank, Mitsubishi and NTT DoCoMo.

Europe

The largest European based stock exchange is based in Amsterdam (Euronext) with a market cap of around $4.34 trillion, closely followed by the London Stock Exchange (LSE) at $4.32 trillion. Some of the largest companies listed on Euronext include American multinational cigarette and tobacco manufacturer Philip Morris, Procter Gamble and HSBC Holdings.

South America

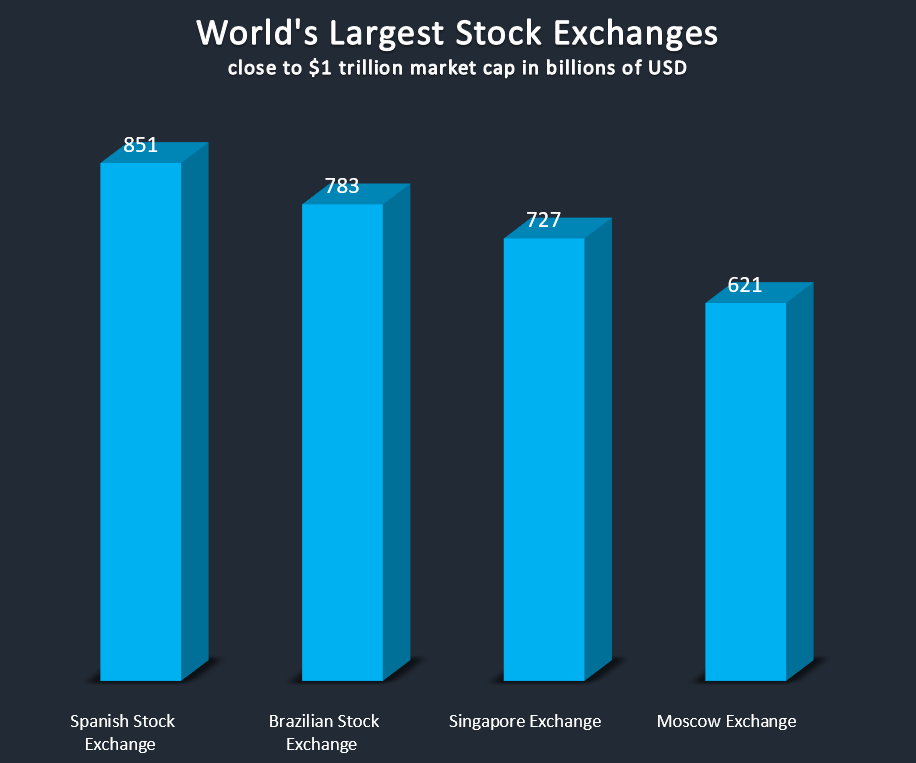

Brazilian Stock Exchange (Bovespa) is the largest in South America and 20th largest in the world with a market cap of around $783 billion, followed by the Mexican Stock Exchange (BMV) at $393 billion.

Africa

Largest stock exchange in Africa is based in Johannesburg (JSE), South Africa with the market cap of just over $1 trillion. It is worth pointing out that it was the first stock exchange to reach $1 trillion market cap in Africa.

Australia

At $1.45 trillion market cap the Australia Stock Exchange (ASX) is the largest in Australia with not much competition to the top spot on the continent. Some of the largest companies include Commonwealth Bank, Westpac Banking Corp, and CSL Limited. The financial sector makes up around 40% of the total market cap of the ASX.

Map of the Largest Stock Exchanges by Continent

Source: Google Maps

Getting Close To A Trillion

The closest stock exchange to join the ”$1 trillion club” is the Spanish Stock Exchange (BME) at $851 billion market cap. Some of the biggest companies listed include Spain’s two largest banks – Banco Santander and BBVA and global energy company Repsol. Brazilian Stock Exchange in Sao Paolo is second closest the $1 trillion market cap at $783 billion. If it does reach the $1 trillion market cap, it will become the first South American stock exchange to reach the milestone. Other two exchanges closest to the milestone include the Singapore (SGX) and Moscow (MOEX) stock exchanges at $727 and $621 billion market cap respectively.

By Klāvs Valters

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Bullish Technical Reversal Trend

By Deepta Bolaky “Buy the Dips” and “Sell the Rallies” are widely followed strategies by new or experienced traders. Buy-the-dip strategy is becoming increasingly popular based on the theory of market fluctuations. It takes into consideration that the market will eventually rally up at pre-dip prices at some point. “Nowadays, trade...

July 31, 2018Read More >Previous Article

Snapshot – NZDCAD, EURUSD, USOIL

NZDCAD - Daily To begin with, let’s take a look at the NZDCAD. Admittedly not the liveliest minor pair but in this instance, I think it is worth ...

July 27, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading