- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Year to Date: ASX Best Performer

- Net profit after tax was up by 24% at $121.2million

- Operation revenue rose by 12% at $570.9 million

- Full-year operating revenue to be approximately $1.24 billion instead of $1.19 billion in November’s guidance.

- Net profit after tax to be within the range of approximately $275 million to $280 million instead of approximately$255 million to $265 million back in November.

News & Analysis

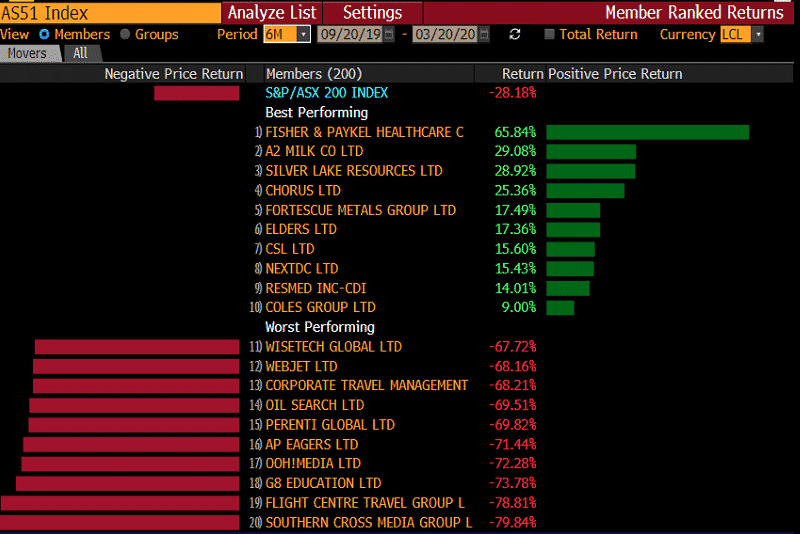

It may be difficult to remain optimistic in such plunging markets. Global equities are in bear market territory and investors are moving away from riskier assets. Amid the mayhem, there might still be some buying opportunities if investors are selective about certain stocks.

We are facing a global pandemic that is slowly forcing major countries into lockdown and halting global activity. Investors are therefore tapping into sectors that offer great bargains or where they see long-term growth opportunities.

The health care sector seems to be on investors’ watchlist. It should be highlighted not all health care stocks are performing the same way.

Fisher & Paykel Healthcare Corp Ltd

In the Australian share market, Fisher & Paykel Healthcare Corp Ltd is standing out. The company is a manufacturer, designer and marketer of products and systems for use in respiratory care, acute care, and the treatment of obstructive sleep apnea.

Fisher & Paykel Healthcare’s share price rose significantly since the widespread of the COVID-19. With a rise of around 25% since the beginning of the year and 74% in the last 6 months, the company is among the best-performing stocks of the S&P/ASX200.

Source: Bloomberg TerminalBack-to-back upgrades

While most companies are downgrading forecasts in this bear market environment, the company has issued two upgrades since the beginning of the year.

Vitera, a new full face mask used in the treatment of obstructive sleep apnoea has outperformed in the early stages. The company also received clearance to sell the mask in the US sooner than expected which contributed meaningfully in driving its share price to new record highs.

The company also delivered a strong financial performance for the six months to 30 September 2019:

The COVID-19 outbreak has substantially increased demand for certain products, which has enabled the company to upgrade its revenue and earnings guidance for the financial year ended 31 March 2020 a couple of times since January.

Taking into consideration exchange rate revisions, the company is now expecting:

On the supply side, the fact that the company does not have a manufacturing facility in China, they are not expecting major supply disruptions. It has actually ramped up production and increased shipments to cope with the increased in demand.

Overall, the company is also making progress with other major initiatives and is establishing a presence in more countries while undertaking numerous other studies.

The continuous growth of the company in the near and medium-term does, therefore, look promising.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Inner Circle Video: Markets in turmoil – Risk and opportunities

At this special Inner Circle session Mike Smith (GO Markets), Cameron Malik and Mark Austin (Magnetic Trading) will be picking apart the events that have led to where we are now and outlining the significant risks and equally opportunities that may exist over the coming days, weeks and months. We looked in detail at Indices, equity markets, comm...

March 20, 2020Read More >Previous Article

Gold Is Being Liquidated

Liquidity Crisis High levels of liquidity happen when there is both supply and demand for an asset, meaning transactions can take place easily. A m...

March 18, 2020Read More >Please share your location to continue.

Check our help guide for more info.

- Trading