- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Zoom reports Q2 results – the stock dips

- 1 month -8.60%

- 3 months +8.56%

- Year-to-date -47.27%

- 1 year -71.59%

- Citigroup $91

- Bernstein $122

- Piper Sandler $115

- Goldman Sachs $142

- Stifel $120

- Benchmark $128

- Deutsche Bank $105

News & AnalysisZoom Video Communications Inc. (ZM) reported its latest financial results after the market close on Wall Street on Monday.

The US communications technology company reported revenue of $1.10 billion for the second quarter (up by 8% year-over-year), falling short of $1.117 billion expected.

Earnings per share reported at $1.05 per share vs. $0.94 per share estimate.

”In Q2, we continued to gain traction as the platform of choice for enterprises looking to deliver flexible, productive solutions for collaboration and customer engagement,” Founder and CEO of Zoom, Eric S. Yuan said in a statement following the results.

”Businesses are drawn to the Zoom platform because of our innovation and modern architecture. Our recently launched Zoom Contact Center and Zoom IQ for Sales products saw some great early wins while Zoom Phone delivered milestone results, hitting a record number of licenses sold in the quarter and reaching nearly 4 million seats, up more than 100% year over year,” Yuan added.

”In Q2, we delivered our fifth straight quarter with revenue of over one billion dollars. While we saw continued momentum with our Enterprise customers and our non-GAAP operating income came in meaningfully higher than our outlook, our revenue was impacted by the strengthening of the U.S. dollar, performance of the online business, and to a lesser extent sales weighted to the backend of the quarter,” said Kelly Steckelberg, CFO of the US company.

”Consequently, we are now expecting to deliver FY23 revenue in the range of $4.385 billion to $4.395 billion. We remain focused on operational discipline, and continue to expect non-GAAP operating margin of approximately 33%,” Steckelberg looked ahead.

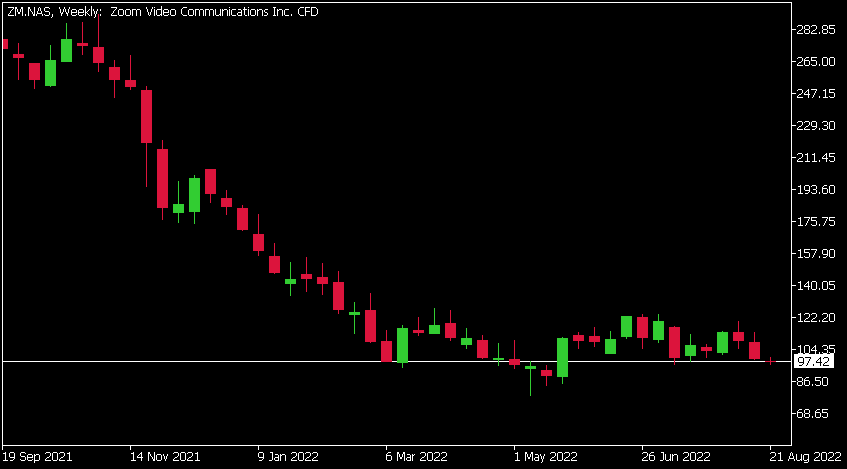

Zoom Video Communications Inc. (ZM) chart

The stock was down by 2.07% at the end of Monday at $97.42 a share. Shares were down by around 8% in the after-hours trading.

Here is how the stock has performed in the past year:

Zoom price targets

Zoom is the 603rd largest company in the world with a market cap of $28.97 billion.

You can trade Zoom Video Communications Inc. (ZM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Zoom Video Communications Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Stocks dump, yields rise as market reprices rate-hike roadmap ahead of Jackson Hole

US equites suffered a steep decline in Mondays session in a broad sell-off that saw the Nasdaq leading the charge lower dropping 2.6% as global risk appetite was pressured by growth and energy supply concerns. The S&P 500 is now down over 200 points since the price was rejected at the 200 day SMA last week. Yields rose sharply a...

August 23, 2022Read More >Previous Article

Deere & Co. results announced

Deere & Co. (DE) reported its financial results on Friday for the third quarter ended July 31, 2022. The American manufacturer of farm machiner...

August 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading