- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Trading Strategies, Psychology

- Are You Appropriately ‘Aroused’ for Peak Trading Performance?

- Home

- News & Analysis

- Trading Strategies, Psychology

- Are You Appropriately ‘Aroused’ for Peak Trading Performance?

- Have an exciting, compelling trading purpose that drives you to do the hard yards with your learning (we know some people fail to complete a course or put learning into action).

- Be motivated to do your due diligence and make sure you have ticked all the boxes before you press any trading buttons and take action with entry and exit.

- Celebrate when you do the right thing (Remember: this includes keeping that loss small when you should) and

- Feel PAIN when you donate to the market needlessly through poor or inappropriate execution (providing of course you take the lesson AND take more appropriate action next time while placing the blame where it should be).

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThere is NO such thing as emotionless trading AND in many respects, it may be considered that it is a good thing too.

After all, correctly targeted emotions will allow you to:So YES, let’s get aroused!

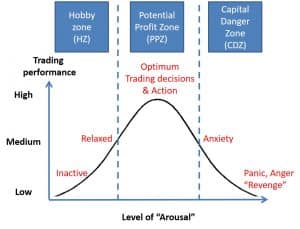

If we hit the right level of trading arousal EVERY TIME and it’s driven by channelled, enabling emotion, this may create a higher probability that when we get to the ‘press-the-button’ stage we do it with a calm confidence and will more likely have a better trading outcome, or as we have called it here the “Potential Profit Zone” (Remember: it is equally a win to make sure that any loss is within your tolerable risk level meaning your long term results are more likely to be positive).

Either extreme of arousal is not likely to produce the results we desire, either through not taking our trading seriously enough (the “Hobby Zone”) to do the things we must (due diligence; careful consideration of strategy selection; making sure it REALLY fits your plan), or though making decisions that are most certainly extreme NOT from the right emotional place (the “Capital Danger Zone”).

Take a look at the diagram below that aims to illustrate this:

This middle zone is where we need to be, so sufficiently stimulated to do the right things consistently (even though these may appear to be a chore and some until they become habits).

If you don’t apply this level of emotion to your trading and trade in the “Hobby Zone”, it is less likely you will be sufficiently “aroused” to spot an opportunity and then trade it without lengthy procrastination. Or equally if not more important to exit a trade in a timely, confident manner either to take profit or minimise any loss from a single trade.

You need to operate with the decisive action of a “trading Ninja” with the appropriate peak state of arousal or in other words in the “Potential Profit Zone”. This may be more likely to give yourself the best chance of optimising trading results.Neither do we want to be in a state of being over-stimulated to the point where you become a trading ‘fruit-loop’ (not the technical term) and perilously exposed to some of the more “dangerous” emotions. To make trading decisions when anxious, angry (that revenge trading thing!), or trading out of fear rarely produces good results and can mutilate a portfolio value quicker than saying “not having a stop loss in place is completely bonkers”.

So, it’s a balance of the two extremes – surely, it is logical that some emotion is good as it motivates you to do the right thing and follow through on your learning, direct trading and measuring, and there are some emotional states that are hugely damaging.

So, your mission after reading this post (as it’s always best to take some action) is to make a ten-second assessment of your ‘state of arousal’ before you press an entry or exit button for every trade this coming week (YES! You can start now). Make the judgement as to which of these described zones you may be trading from.

One final word: if you want evidence of whether the right state of arousal is likely to produce peak performance, then look at other situations where that might also be the case….just a different context, that’s all.GET AROUSED!

PS Aroused to learn what you need to, but are not sure where to go? Why not access your FREE “Next Steps” education course including two group coaching webinars sessions to help put LIVE market context to the theory learned in the videos? For more information click on the “Next Steps” image on the right.

This article is written by an external Analyst and is based on his independent analysis. He remains fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading, check out our forex webinar.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#ForexStrategy #ForexTrading #ForexTraining #ForexCourse #ForexEducation #ForexHelp #ForexAnalysis #FXSignal #MetaTrader #MetaTrader4 #MetaTrader5Next Article

Margin Call Podcast – S1 E9: Quinn Perrott | Co-Founder & General Manager of TRAction Fintech

Quinn Perrott (Linkedin) is the Co-Founder & General Manager of TRAction Fintech, a regulatory technology business. Quinn has been a long time operator in the Retail Forex space, whether it’s running leading businesses like City Index and AxiTrader, or deciding to create a business in the niche space of regulatory technology. He has a uni...

March 13, 2019Read More >Previous Article

US–China Trade Gap at Record High

US-China Trade Gap at Record High Trade Deficit a Decade High- Was a Trade War Worth it? The Trade Deficit reported mid-week surprised the markets...

March 7, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading