- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Trading Strategies, Psychology

- How to use Arbitrage trading to increase profits

- Home

- News & Analysis

- Trading Strategies, Psychology

- How to use Arbitrage trading to increase profits

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisHow to use Arbitrage trading to increase profits

Professionals in finance like to use hard to read and complicated language to make what they do much harder and more complicated than it sounds. However, when it comes to arbitrage, it is actually a relatively simple concept that can be used in trading, to develop an accurate system that can be used in various markets.

The Law of One Price

In order to understand Arbitrage trading, a trader needs to understand the law of one price. It states that the same goods sold in different markets in conditions, free of competition and expressed in the same currency, must be sold at the same price. Although this is an economic theory, the principles follow into financial markets. This means that in an efficient market, prices for the same asset cannot be different. In practice, this is not always the case or rather it is not always the case straight away and his is where arbitrage opportunities exist as the market tries to move the prices into one.

What is an Arbitrage?

An arbitrage is when the law of one price has not yet been realized. Essentially, the market is in the process of converging the prices. The best example is that of dual listed companies. These are companies who have shares listed on multiple exchanges. Initially the price may be different due to exchange rates, different number of shares on issue. However, the relative value for each share must be the same. Usually, they are larger companies or multinational companies. For instance, BHP is listed on both the ASX and the London Stock Exchange. The strategy can involve selling the shares on the exchange where it is more expensive and buying them back on the cheaper exchange or the alternative and profiting the difference.

Other arbitrage opportunities can exist in companies that are primarily traded on an exchange but also have an over the counter, (OTC) listing. These OTC listings are often much more illiquid allowing for more arbitrage opportunities Additionally, the primary market will usually be the lead pricing target, whilst the OTC or secondary market will attempt to move towards that price.

Merged Arbitrage

This strategy involved targeting companies that are in the process of being taken over or bought out. The acquirer will need to put an offer per share in order for a take-over to occur. This gives the market a value for the shares. Generally speaking, the price will have to move towards the offer, especially if it is accepted.

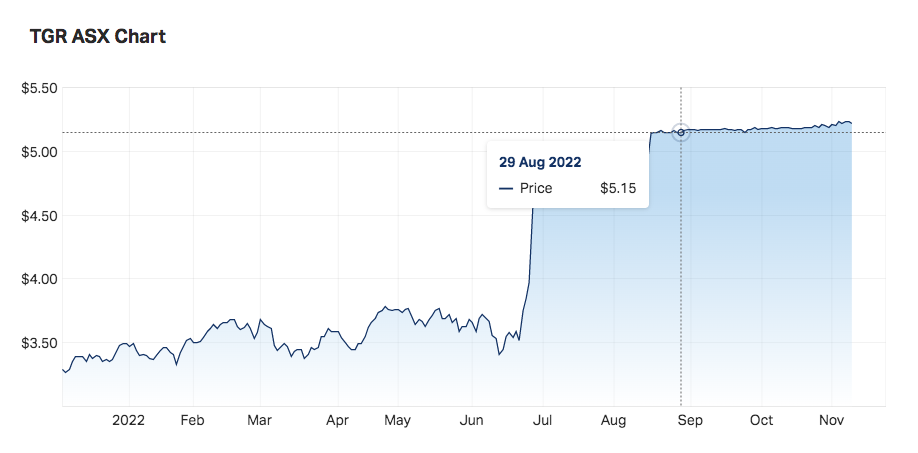

In a recent example, company Tassal formally TGR.AX, announced it was being bought out by a private equity firm. There were previous offers made at $4.67, $4.80 and $4.85 per share before the final offer came at $5.25 a share. It can be seen from the price chart that the share price did not reach $5.25 immediately. The interesting thing to note here is that even though the final and accepted offer came in at $5.25 on the day of the announcement the price only reached $5.12 still $0.13 short of the offer. This represented an arbitrage opportunity of $0.13 for savvy traders and investors. Although the actual % gain was not very high, the relative certainty of the price target made this trade a potential big winner. Opportunities like this are not always perfect and deals may not always follow through, but a skilled trader can develop a very strong system around this premise.

Overall, arbitrage trading may seem difficult but in reality, the theory is relatively straight forward. Finding mispricing within the market and capitalising on them can take some practice but they can also offer longer and shorter terms edges when the market is not providing other sufficient trading opportunities.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#ForexStrategy #ForexTrading #ForexTraining #ForexCourse #ForexEducation #ForexHelp #ForexAnalysis #FXSignal #MetaTrader #MetaTrader4 #MetaTrader5Next Article

Salesforce tops Q3 estimates, Co-CEO steps down

The world’s leading customer relationship management company Salesforce Inc. (NYSE: CRM) announced its latest financial results after the market close in the US on Wednesday. The company beat both revenue and earnings per share (EPS) estimates. Revenue reported at $7.84 billion (up by 14% year-over-year) vs. $7.827 billion expected. EPS ...

December 2, 2022Read More >Previous Article

Bitcoin rockets after powerful spike

Bitcoin rockets powerful spike Bitcoin’s price has seemingly spiked out of nowhere in what has been in one of its strongest moves in days...

November 30, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading