- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Trading Strategies, Psychology

- Why you need to know about Expected Value

- Home

- News & Analysis

- Trading Strategies, Psychology

- Why you need to know about Expected Value

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMany traders early on in their trading journey may jump into trading without knowing if their system or edge can be profitable. The most important metric that a trader should measure their system on is by using expected value. This essentially wors out the average return that the system will return for every trade that it makes, considering both winning trades and losing trades. The formular for the expected value is written below.

Expected Value = (Probability of winning trade X Average Winning Trade Value) – (Probability of a Losing trade X Average Loss)

For example, Trader A

– Wins 40% of their trades

– Loses 60% of their trades

– Average win = $20

– Average Loss = $10

Therefore, Expected Value = (0.4×20) – (0.6×10)

= $2

This means over the long run the system will return $2.00 per trade made.

This relationship describes any trading strategy or edge’s average performance per trade. Therefore, by determining the expected value a trader can see how effective their edge will be excluding slippage and transaction costs in the long term.

Risk and Return

The relationship also shows that a strategy does not need to necessarily win every single trade to be profitable. The rule of risk and reward is that they are inversely correlated. This means that the more a trader is willing to risk, whether it be size or distance to a stop loss the higher potential reward. Alternatively, the less risk a trader takes the lower potential reward. It doesn’t matter which type of trader you are often different personality types will gravitate to either more frequent winning and smaller winnings or larger winnings, but a smaller number of wins.

In fact, a trader may only need to be profitable on 20% of their trades if they can ensure that their average winning trades are more profitable by a factor of 5:1. A strategy that wins more frequently may only need a smaller average win vs its average loss. When testing a system, it is important that there is sufficient data to ensure the inputs for the above formula is accurate. This means using data from various time periods and potentially across a range of markets to measure the Expected Value of the system.

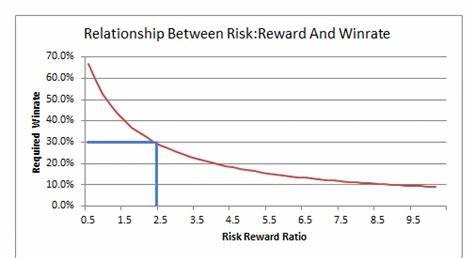

See below for the required a=Average Winning trade/Average Loss trade per Average win rate for a breakeven trading system.

Ultimately it is vital that when assessing the performance of a trading strategy or edge to be able to measure the profitability of the system. The best way to do this is by using expected value. Profitable trading strategies can be made with either a high win rate and low average W/L ratio or a low winning strategy with a high W/L ratio.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#ForexStrategy #ForexTrading #ForexTraining #ForexCourse #ForexEducation #ForexHelp #ForexAnalysis #FXSignal #MetaTrader #MetaTrader4 #MetaTrader5Next Article

Why you need to understand this market concept to improve your trading: Market Correlation

Why you need to understand this market concept to improve your trading: Market Correlation For new traders and experienced traders, it can be daunting trying to find the best assets to trade. Whether it be equities, foreign exchange or indices, traders should be trying to have as many factors pointing in their favour as possible when entering a ...

December 21, 2022Read More >Previous Article

US stocks see mild gains, Yen surges, dollar dumps after BoJ surprise

US indices managed to finish in the green after breaking a four-day losing streak despite the BoJ roiling risk markets with an unexpected change to th...

December 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading